CredCore's DNA

AI, technology and experts that adapt to you; not the other way round.

Our Focus

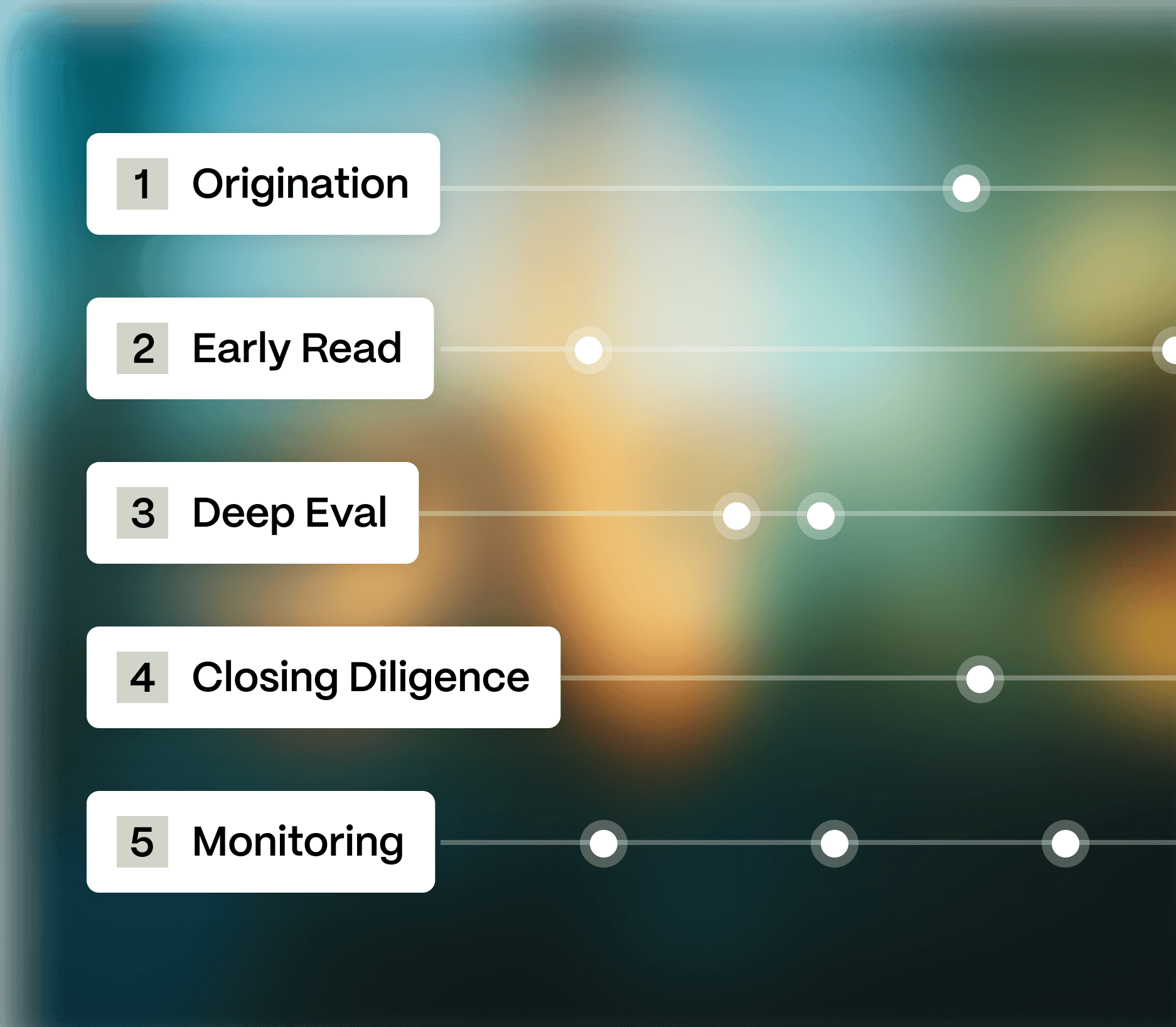

We target the most complex, intractable parts of enterprise debt workflows: origination; evaluation, diligence, and portfolio monitoring.

How we do it

Tusk’s AI analyzes unstructured data across the credit lifecycle to reveal hidden insights. Validated by in-house lawyers and experts, we deliver speed, accuracy, and full compliance.

Featured Asset Classes & Documents processed

CredCore manages complex credit instruments across the debt stack, capturing every custom nuance: use cases, actors, structure, and legal.

Why Firms choose CredCore?

AI, technology and experts that adapt to you; not the other way round.

Who Uses CredCore?

CredCore solves the fundamental friction points that slow down the credit market. Proven customer results show: lower costs, faster execution, unlocked capacity, revenue gain, and AUM growth.

Getting started is easy

All your deals consolidated into an intuitive dashboard, fast & accurately.

CredCore is built for scale, designed for Debt

Ours is a purpose-built technology: created from the ground up by AI engineers & debt experts

$

T

AUM served today

$

T

Debt Corpus

+

Years

We provide the highest level of Industry-leading Security & Compliance

SOC 2 Type II

ISO/IEC 27001

ISO/IEC 42001

Row-level Encryption

Role-Based Access

Accelerate your deal execution today

Stop relying on generic tools. Modernize your workflow with a platform built for complex credit data.

By submitting this form, you agree to CredCore processing your personal data to respond to your request. See our Privacy Policy.